A home is one of the biggest investment we make. Just like other valuable purchase, we want to ensure that it is properly insured and to mitigate any unforeseen circumstances.

Home insurance serves to recompensate you financially in the unfortunate event in losses or damages to your property. We shall dive into different types of home insurance in Malaysia and how you can claim for it.

Types of Home Insurance

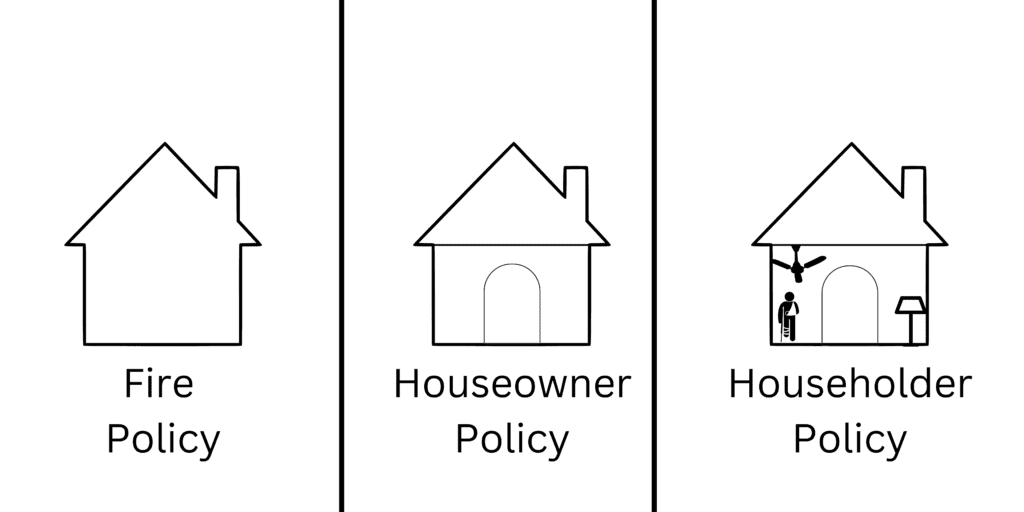

Home insurance are packaged in many ways depending on the banks. Generally, it can be broken down to three home insurance policy

- Fire Policy

- Fire policy covers the loss or damages to your property in the unfortunate event where a property is damaged due to fire and lighting. For an additional premium, this policy can also be extended to include damages from storm, earthquakes, floods, explosion, etc.

- Houseowner Policy

- Houseowner policy covers the loss or damages to your property and components in your house. It provides additional cover on top of fire policy. For example, roof, walls, fixtures etc are covered within the houseowner policy

- Householder Policy

- Householder policy covers the loss or damage to the contents of your house. On top of providing coverage for the property and its content. This policy also covers for fatal injuries

You can view this as an upgrade for each policy. The diagram below will show a simple explanation to the policy

Strata/Individual Property

If you own a strata or individual property, your Joint Management Body (JMB) has insured your property with fire policy. Make sure that you cross check with the master policy by your JMB.

How much to pay for home insurance

Persatuan Insurans Am Malaysia (PIAM) has a Building Cost Calculator which allows you to get an estimate of the rebuilding cost of your property.

Claim Home Insurance

In the event where you had to file for a home insurance claim, you will need to:

- Lodge a police report or fire brigade report based on the incident

- Inform insurance company. Describe the incident, including the time and date of the incident, as well as the cause of incident.

- Fill up insurance claim form

- Submitting your documents which consist of list of damaged items, invoices of items, replacement quotations, police or fire brigade report

- Verify reimbursement amount

- Receive payout

In the meantime, you can also request quotation from contractors for repair or rebuild. Don’t know where to look? You can find it here.

Related articles

Check out these other articles and guides which we thought you might also like.